Delhi NCR has firmly established itself as one of India’s most promising and dynamic real estate markets. Over the past decade, the region has witnessed rapid urbanization, massive infrastructure upgrades. And consistent demand from homebuyers and investors alike. As we move closer to 2026. Delhi NCR is entering a new phase of growth that makes it an ideal destination for real estate investment. From residential apartments and plotted developments to commercial and mixed-use projects. The region offers diverse opportunities for investors seeking long-term capital appreciation and stable returns.

The combination of strategic location, economic expansion, and future-ready infrastructure places Delhi NCR. At the forefront of India’s real estate landscape. Unlike many other markets that experience cyclical demand. Delhi NCR continues to show resilience due to its strong employment base, connectivity, and ongoing development projects. For investors planning to enter the market in 2026, this region presents a well-balanced mix of safety, growth, and profitability.

Delhi NCR’s Future Growth – A Strong Foundation for Investors

The future growth of Delhi NCR is backed by long-term planning and sustained economic activity. Cities such as Noida, Greater Noida, Gurugram, Ghaziabad, and Faridabad. Have evolved into independent urban centers with robust residential, commercial, and social infrastructure. These cities are no longer dependent solely on Delhi for employment or lifestyle needs, which has significantly strengthened the real estate ecosystem across the NCR region.

With the expansion of IT hubs, corporate parks, industrial corridors, and startup zones, Delhi NCR continues to attract professionals from across the country. This steady influx of working professionals and entrepreneurs is driving consistent demand for quality housing. As a result, residential real estate in well-connected locations is expected to witness strong price appreciation by 2026.

Another major factor contributing to future growth is the government’s focus on planned urban development. Smart city initiatives, integrated townships, and sustainable housing projects are reshaping the way people live and work in NCR. Investors who enter the market at this stage are likely to benefit from early-stage pricing and long-term value creation as these developments mature.

Infrastructure Boom – The Biggest Growth Driver in 2026

One of the strongest reasons to invest in Delhi NCR real estate in 2026 is the massive infrastructure boom transforming the region. Large-scale projects such as expressways, metro expansions, and new connectivity corridors are significantly reducing travel time and improving accessibility. Improved infrastructure not only enhances the quality of life but also plays a crucial role in increasing property values.

Key infrastructure developments like the Dwarka Expressway, Noida International Airport (Jewar Airport), Delhi–Mumbai Expressway, and expanded metro networks are creating new real estate hotspots. Locations that were once considered peripheral are now emerging as high-potential investment zones. As connectivity improves, demand for residential and commercial properties in these areas is expected to rise sharply.

The impact of infrastructure on real estate appreciation is already visible in many parts of NCR. Areas near expressways and metro corridors have seen faster price growth compared to poorly connected locations. By 2026, as several major infrastructure projects become fully operational, property prices in surrounding regions are likely to witness significant upward movement, making this the right time for investors to enter the market.

Rising Investor Demand and Capital Appreciation Potential

Investor demand in Delhi NCR real estate has been steadily increasing, driven by improved transparency, better project delivery, and a growing preference for real assets. The implementation of RERA has played a crucial role in restoring investor confidence by ensuring accountability, timely delivery, and legal clarity. This has encouraged both end-users and investors to actively participate in the market.

In 2026, real estate in Delhi NCR is expected to offer attractive capital appreciation compared to traditional investment options. With limited availability of prime land in central locations and increasing construction costs, property prices are likely to rise in the medium to long term. Investors who invest in the right projects and locations can benefit from substantial value appreciation over the next few years.

Rental demand is another important factor supporting investor interest. NCR’s strong employment base ensures consistent demand for rental housing, especially in cities like Gurugram and Noida. Properties located near IT parks, business districts, and metro stations offer higher rental yields and lower vacancy risks. For investors looking for regular income along with long-term appreciation, Delhi NCR presents a balanced investment opportunity.

A Diverse Market Offering Multiple Investment Options

One of the key advantages of investing in Delhi NCR is the diversity of real estate options available. Investors can choose from luxury apartments, mid-segment homes, affordable housing, plotted developments, and commercial properties depending on their budget and investment goals. This flexibility makes NCR suitable for both first-time investors and seasoned real estate buyers.

Luxury projects in prime locations promise high appreciation, while affordable and mid-segment projects offer stable demand and easier liquidity. Plotted developments along emerging corridors such as Yamuna Expressway are gaining popularity due to their long-term growth potential. Commercial real estate, including office spaces and retail projects, continues to attract investors seeking higher rental yields.

This wide range of choices allows investors to create a diversified real estate portfolio within the same region, reducing risk while maximizing returns.

Also Read: Top 50 Real Estate Builders in Delhi NCR

Why 2026 Is the Right Time to Invest in Delhi NCR

The year 2026 is shaping up to be a landmark phase for real estate investment in Delhi NCR. After years of consistent planning, infrastructure execution, and policy reforms, the region is now entering a maturity stage where both end-users and investors can expect stable growth and strong returns. Market indicators such as rising demand, improved connectivity, and increased buyer confidence clearly suggest that Delhi NCR is well-positioned for long-term real estate appreciation. For investors looking to maximize returns while minimizing risk, 2026 presents an ideal entry point.

Strong Infrastructure Development

One of the biggest reasons why 2026 is the right time to invest in Delhi NCR is the region’s massive infrastructure development. Over the past few years, the government has focused heavily on improving road networks, metro connectivity, and expressway corridors, transforming the overall real estate landscape. Major infrastructure projects are either nearing completion or becoming fully operational by 2026, significantly boosting property values in surrounding areas.

Key developments such as the Dwarka Expressway, Noida International Airport (Jewar), Delhi–Mumbai Expressway, and the expansion of metro lines across Noida, Greater Noida, and Gurugram are creating new real estate growth corridors. These projects are reducing travel time, enhancing connectivity, and making previously underdeveloped areas more accessible and attractive for investment.

Infrastructure plays a direct role in real estate appreciation. Properties located near expressways, metro stations, and business hubs tend to witness faster price growth and higher rental demand. As infrastructure upgrades continue to reshape NCR, investors entering the market in 2026 can benefit from early-stage appreciation before prices peak. This makes infrastructure-led locations one of the safest and most profitable investment options in the region.

Rising Property Demand & Price Appreciation

Another strong indicator that 2026 is the right time to invest in Delhi NCR is the consistent rise in property demand. With a growing population, increasing urban migration, and a strong employment base, demand for residential and commercial real estate continues to outpace supply in prime locations. Cities like Noida, Gurugram, and Greater Noida have become major employment hubs, driving continuous housing demand from working professionals and families.

The demand-supply gap, especially in well-planned and well-connected areas, is expected to push property prices upward over the next few years. Limited availability of land in prime locations, rising construction costs, and increased preference for branded developments are further contributing to price appreciation. Investors who enter the market in 2026 are likely to benefit from this upward price cycle.

Rental demand is also on the rise, supported by the presence of IT parks, corporate offices, and commercial zones. Properties near business districts and metro corridors offer attractive rental yields, making them ideal for investors seeking steady income along with capital growth. As job opportunities continue to expand in NCR, rental values are expected to grow steadily, improving overall return on investment.

Government Policies & RERA Transparency

Government reforms and regulatory transparency have significantly improved investor confidence in Delhi NCR’s real estate market. The implementation of the Real Estate (Regulation and Development) Act, commonly known as RERA, has brought accountability, transparency, and legal security for buyers and investors. RERA ensures timely project delivery, protects buyer interests, and reduces the risk of fraud, making real estate investment safer than ever before.

In addition to RERA, supportive government policies such as infrastructure-led development, housing incentives, and smart city initiatives have further strengthened the real estate ecosystem. These policies encourage organized development and attract reputed builders to launch quality projects across NCR. As a result, investors now have access to well-planned, legally compliant, and professionally managed real estate projects.

The combined impact of strong regulations and government support has created a stable investment environment. By 2026, the market is expected to be more mature, transparent, and trustworthy, reducing speculative risks and increasing long-term value. This regulatory clarity makes Delhi NCR an ideal destination for both domestic and NRI investors looking for secure and profitable real estate opportunities.

Also Read: Godrej Arden Greater Noida

Key Factors to Consider Before Investing in Real Estate

Investing in real estate is one of the most effective ways to build long-term wealth, but the success of any property investment depends on careful evaluation and informed decision-making. Especially in a competitive and diverse market like Delhi NCR, investors must analyze multiple factors before committing their capital. Understanding key aspects such as location, builder credibility, legal compliance, pricing, and future growth potential can significantly reduce risks and improve overall returns. Below are the most important factors every investor should consider before investing in real estate.

Location & Connectivity

Location is the most critical factor in real estate investment and often determines the future appreciation and demand of a property. In Delhi NCR, properties located in well-connected areas tend to perform better in terms of both capital growth and rental income. Proximity to expressways, metro stations, business hubs, schools, hospitals, and commercial zones plays a major role in influencing buyer and tenant demand.

Connectivity-driven locations such as areas near Dwarka Expressway, Noida-Greater Noida Expressway, Yamuna Expressway, and metro corridors are witnessing rapid development. Improved connectivity not only reduces travel time but also enhances the livability and desirability of a location. Investors should focus on micro-markets with ongoing or upcoming infrastructure projects, as these areas usually experience faster appreciation once development is completed.

Builder Reputation & Track Record

The reputation and track record of the builder are equally important when investing in real estate. A reputed developer with a history of timely delivery, quality construction, and transparent dealings significantly lowers investment risk. In Delhi NCR, well-known builders tend to attract higher demand, ensuring better resale value and rental potential.

Before investing, investors should evaluate the builder’s past projects, delivery timelines, construction quality, and customer reviews. Projects developed by trusted and established builders also tend to comply better with regulatory norms and offer superior amenities and maintenance. Choosing a credible builder not only ensures peace of mind but also enhances the long-term value of the investment.

RERA Approval & Legal Compliance

Legal compliance is a crucial aspect of real estate investment, and investors must ensure that the project is fully RERA-approved. The Real Estate (Regulation and Development) Act has introduced transparency and accountability in the sector, protecting buyers from delays and misleading practices. RERA-approved projects provide clear information about project timelines, approvals, and legal status.

Investing in a legally compliant project reduces the risk of disputes, delays, and financial losses. Investors should verify RERA registration numbers, land titles, approvals, and compliance documents before finalizing a deal. In a regulated market like Delhi NCR, RERA-compliant projects offer greater security and long-term stability, making them ideal for both end-users and investors.

Price, Payment Plans & ROI

Pricing is a key determinant of investment success. Investors should compare property prices across similar locations and projects to ensure they are getting fair value. Overpriced properties may limit future appreciation, while competitively priced projects with strong fundamentals offer better return on investment (ROI).

Flexible payment plans, construction-linked plans, and festive offers can further enhance investment feasibility. Investors should analyze the total cost, including taxes, registration, and maintenance charges, to assess the actual investment value. Calculating expected ROI based on appreciation potential and rental income helps investors make data-driven decisions and maximize long-term gains.

Rental Yield & Future Growth

Rental yield is an important consideration for investors seeking regular income. Properties located near IT hubs, corporate offices, educational institutions, and metro stations typically offer higher rental demand and lower vacancy risks. In cities like Gurugram and Noida, rental yields remain attractive due to strong employment opportunities.

Future growth potential is equally important. Investors should identify areas with upcoming infrastructure, commercial development, and planned urban expansion. Locations with strong future prospects tend to offer better appreciation and rental growth over time. By focusing on properties with high rental demand and long-term growth visibility, investors can ensure consistent returns and asset value appreciation.

Also Read: Flat in Noida Expressway – A Prime Location to Buy Property

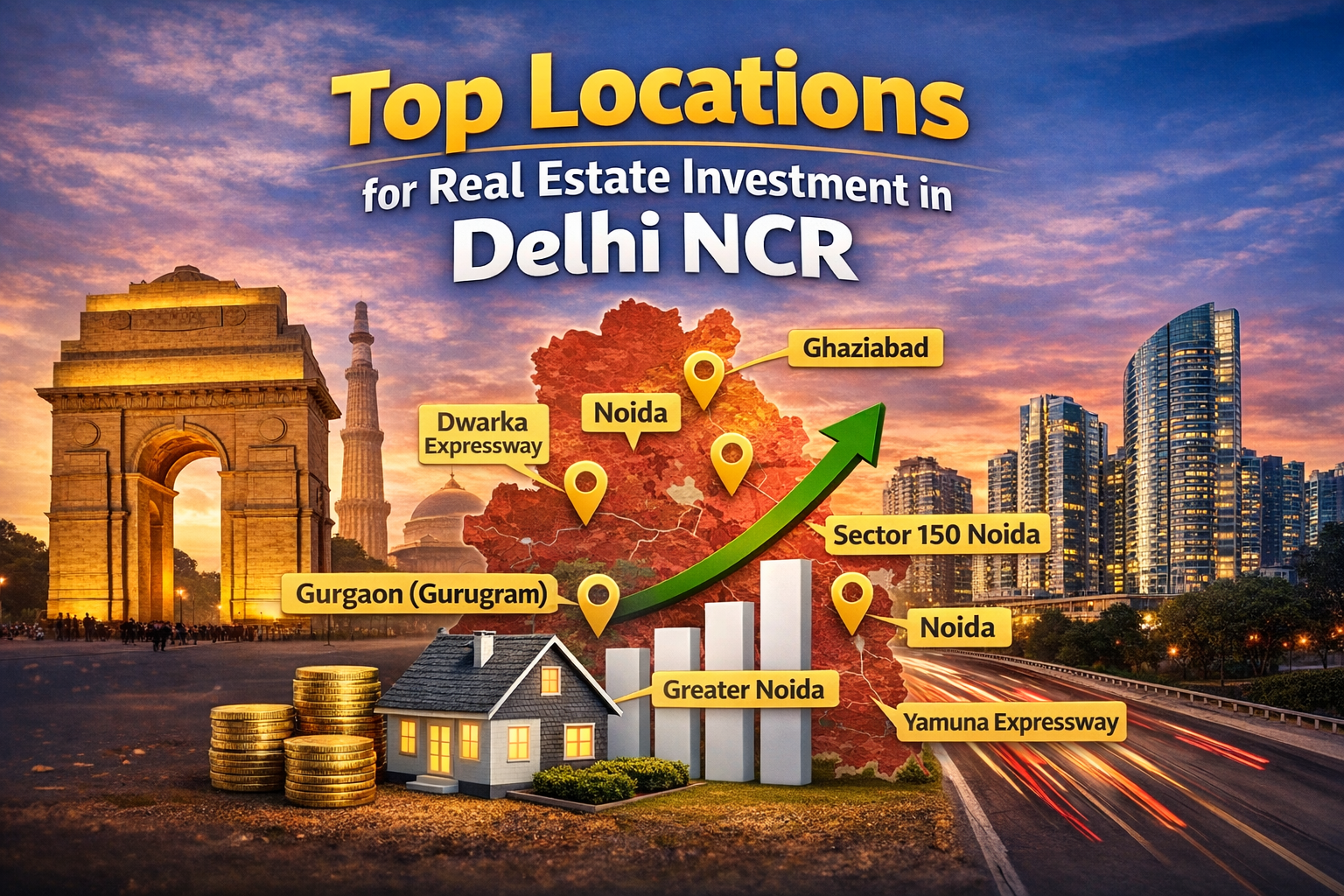

Top Locations for Real Estate Investment in Delhi NCR (2026)

Choosing the right location is the most important decision when investing in real estate, especially in a vast and diverse market like Delhi NCR. In 2026, several micro-markets across NCR are emerging as high-potential investment destinations due to infrastructure development, improved connectivity, and strong demand from end-users and investors. Locations such as Noida, Greater Noida, Gurugram, and Ghaziabad continue to attract attention because of their strategic positioning, employment opportunities, and future growth prospects.

Below are the top locations for real estate investment in Delhi NCR in 2026 that offer a balanced combination of affordability, appreciation, and rental potential.

Noida & Noida Extension

Noida and Noida Extension remain among the most preferred real estate investment destinations in Delhi NCR. Known for their well-planned infrastructure, wide roads, and strong connectivity, these areas have witnessed consistent residential and commercial growth. The presence of IT parks, corporate offices, and educational institutions has created steady housing demand, making Noida a reliable market for both investors and end-users.

Noida Extension, also known as Greater Noida West, offers comparatively affordable property prices with strong appreciation potential. Improved connectivity via the Noida-Greater Noida Expressway, upcoming metro extensions, and proximity to central Noida make this area attractive for long-term investment. In 2026, Noida and Noida Extension are expected to benefit further from infrastructure upgrades and increasing demand, resulting in higher property values and rental returns.

Greater Noida & Yamuna Expressway

Greater Noida and the Yamuna Expressway corridor are emerging as high-growth investment zones in Delhi NCR. These areas are gaining popularity due to large-scale planned development, wide availability of land, and competitive pricing. The region offers a mix of residential projects, plotted developments, and upcoming commercial hubs, making it suitable for long-term investors.

The upcoming Noida International Airport at Jewar is a major growth driver for this region. Once fully operational, it is expected to significantly boost economic activity, employment opportunities, and real estate demand along the Yamuna Expressway. Investors entering the market in 2026 can benefit from early-stage pricing and long-term appreciation as infrastructure and development mature over the coming years.

Gurgaon & Dwarka Expressway

Gurugram continues to be one of the strongest real estate markets in Delhi NCR, driven by its status as a major corporate and commercial hub. The city hosts numerous multinational companies, IT firms, and business parks, ensuring consistent demand for residential and commercial properties. Gurugram’s premium locations offer high rental yields and strong appreciation potential, making it ideal for seasoned investors.

The Dwarka Expressway has emerged as a key investment corridor connecting Gurugram with Delhi. With improved road infrastructure, metro connectivity plans, and proximity to the airport, this region is witnessing rapid residential and commercial development. In 2026, properties along Dwarka Expressway are expected to see significant price appreciation as connectivity improves and demand increases, making it one of the most promising investment destinations in NCR.

Ghaziabad & NH-24 Corridor

Ghaziabad, particularly the NH-24 (Delhi–Meerut Expressway) corridor, has transformed into a strong residential and commercial market. Improved road infrastructure, better connectivity to Delhi and Noida, and the development of integrated townships have enhanced the region’s real estate appeal. Ghaziabad offers comparatively affordable property prices, attracting first-time buyers and investors alike.

The NH-24 corridor has benefited from expressway upgrades, metro connectivity, and growing social infrastructure such as schools, hospitals, and shopping centers. These factors have led to increased demand and gradual price appreciation. In 2026, Ghaziabad is expected to continue its growth trajectory, offering stable returns and good rental demand for investors seeking value-for-money opportunities.

Also Read: Great Value Ekanam Sector 107 Noida: Premium 3 & 4 BHK Apartments

Top Real Estate Projects in Delhi NCR for Investment in 2026

1. Clove County Sector 151 Noida

Project Overview: Clove County is a well-planned residential project located in Sector 151 Noida Expressway. The project is designed to offer modern living with quality construction, landscaped open spaces, and essential lifestyle amenities. Its strategic location ensures smooth connectivity to Noida, Greater Noida, and Delhi, making it a preferred choice for both homebuyers and real estate investors.

RERA No.: 696539/11/2025

Configuration: 4 BHK & 5 BHK ultra luxury residential apartments

Size: 4077 Sq.ft. | 5310 Sq.ft. | 6417 Sq.ft.

Price Starting From: ₹7.13 Cr* (approx., subject to change)

Investment Potential: Clove County offers strong investment potential due to its location in a fast-developing residential corridor with rising housing demand. The area is witnessing continuous infrastructure growth, improved road connectivity, and increasing social amenities, which support steady capital appreciation. Additionally, the demand for rental housing in Noida Extension makes this project suitable for investors seeking long-term value growth along with stable rental income. Read More..

2. Godrej Majesty – Sector 12, Greater Noida West (Noida Extension)

Project Overview: Godrej Majesty is a premium residential project by Godrej Properties, located in Sector 12, Greater Noida West. Designed for modern urban living, the project offers spacious homes, world-class amenities, and superior construction quality backed by the trusted Godrej brand. Its strategic location ensures excellent connectivity to Noida, Greater Noida, and key employment hubs, making it a strong choice for both end-users and long-term investors.

RERA No.: UPRERAPRJ250823

Configuration: 3 BHK & 4 BHK luxury apartments

Size: 2503 SqFt. | 2576 SqFt. | 2799 SqFt.

Price Starting From: ₹3.54 Cr* (approx., subject to change)

Investment Potential: Godrej Majesty holds high investment potential due to its premium positioning, brand value, and location in a rapidly developing residential zone. Properties by Godrej Properties generally witness strong appreciation and high resale demand. With improving infrastructure, rising demand for luxury homes in Noida Extension, and limited supply of branded developments, this project is well-suited for investors seeking long-term capital appreciation along with strong rental demand. Read More…

3. Jade County – Wave City, NH-24, Ghaziabad

Project Overview: Jade County is a premium residential project located in Wave City, NH-24, Ghaziabad, offering thoughtfully designed homes with modern amenities and a well-planned living environment. The project enjoys excellent connectivity to central Noida, Noida-Greater Noida Expressway, and key commercial hubs, making it an attractive option for both homebuyers and real estate investors.

RERA No.: UPRERAPRJ26795

Configuration: 3 BHK, 4 BHK and 5 BHK luxury apartments

Size: 2358 SQFT. | 2898 SQFT. | 3555 SQFT. | 5094 SQFT.

Price Starting From: ₹2.6 Cr* (approx., subject to change)

Investment Potential: Jade County offers strong investment potential due to its prime location in a well-developed sector of Noida with limited availability of new residential projects. The area has consistent end-user demand, which supports healthy price appreciation and rental income. With improving infrastructure, proximity to business districts, and a premium residential environment, Jade County is a suitable investment option for 2026 for investors seeking long-term value growth. Read More…

4. AU Aspire Silicon City – Sector 76, Noida

Project Overview: AU Aspire Silicon City is a premium residential project located in Sector 76, Noida, one of the well-developed and highly demanded residential sectors of the city. The project offers modern apartments with quality construction, lifestyle amenities, and a secure living environment. Its prime location ensures excellent connectivity to Sector 50, Sector 52, Noida City Centre, and major business hubs, making it attractive for both end-users and investors.

Configuration:3 BHK, 4 BHK Flats and Duplex Penthouse

Size: 2781 SQFT. | 3342 SQFT. | 5923 SQFT.

Price Range: ₹3.90 Cr* (approx., subject to change)

Investment Potential: AU Aspire Silicon City holds strong investment potential due to its location in a mature and well-connected Noida sector with limited new supply. High demand from working professionals, proximity to metro stations, and well-established social infrastructure support steady rental income and capital appreciation. For investors looking for a low-risk, high-demand residential investment in Noida, this project is a solid choice for 2026. Read More…

5. AU The Sunflower – NH‑24, Ghaziabad (Aditya World City)

Project Overview:

AU The Sunflower is an ultra‑luxury residential project by AU Real Estate located along the NH‑24 corridor in Ghaziabad, within the prestigious integrated township of Aditya World City. Spread over approx. 9 acres, this project offers spacious and premium residences designed for modern living and elevated lifestyle. With world‑class amenities and strong connectivity to major parts of NCR, it appeals to homebuyers who seek luxury as well as investors looking for long‑term appreciation.

Configuration: 3 BHK ultra‑luxury apartments

Size: 2975, 3800 and 4000 Sq.Ft.

Price Range: Approx. ₹2.82 Cr* (approx., subject to change)

Investment Potential:

AU The Sunflower holds strong investment potential due to its premium location on NH‑24, one of Ghaziabad’s fastest‑growing residential and commercial corridors. The project’s proximity to the Delhi‑Meerut Expressway, metro stations, railway station and key social infrastructure supports strong demand from families and professionals alike. With limited supply of ultra‑luxury homes in this zone and increasing attention from NCR buyers, property values in The Sunflower are likely to appreciate steadily by 2026 and beyond. Additionally, high‑end amenities and branded quality construction improve rental desirability, making it a worthwhile choice for investors focused on both capital gain and rental yield. Read More…

6. Prestige City – NH‑24, Siddharth Vihar, Ghaziabad

Project Overview: Prestige City is a premium residential township by Prestige Group, strategically located along NH‑24 in Siddharth Vihar, Ghaziabad. Spread across 62+ acres, the project offers thoughtfully designed apartments with modern amenities, landscaped green spaces, and a secure community environment. Its strategic location ensures smooth connectivity to Delhi, Noida, and other NCR hubs, making it attractive for both homebuyers and long-term investors.

Configuration & Size:

-

2 BHK Apartments – 1,100 to 1,300 sq.ft.

-

3 BHK Apartments – 1,600 to 2,100 sq.ft.

-

4 BHK Apartments – 2,500 to 3,000 sq.ft.

-

5 BHK Apartments – 3,200 to 3,500 sq.ft.

Price Range: Approx. ₹1.50 Cr* to ₹4.0+ Cr* (depending on size and floor plan)

Investment Potential: Prestige City offers strong investment potential due to its:

-

Prime Location: Located on NH‑24, with excellent connectivity to Delhi, Noida, and nearby employment hubs, ensuring high demand from residents and tenants.

-

Reputed Developer: Built by Prestige Group, a trusted real estate developer known for quality construction and timely delivery, which increases resale value.

-

Large Township Advantage: With over 60 acres of planned development, the project provides a family-friendly, community-oriented environment, enhancing long-term livability and demand.

-

Lifestyle & Amenities: Offers modern amenities such as clubhouses, landscaped parks, children’s play areas, swimming pools, and sports facilities, making it attractive for both residents and tenants.

With its strategic location, premium amenities, and large township setup, Prestige City is expected to witness strong capital appreciation and healthy rental yields by 2026. Investors can expect steady returns and long-term growth, making it a reliable investment option in Ghaziabad’s NH‑24 corridor. Read More…

7. Godrej Arden – Sector Sigma 3, Greater Noida

Project Overview:

Godrej Arden is a premium residential project by Godrej Properties located in Sector Sigma 3, Greater Noida, one of the rapidly developing corridors in Delhi NCR with excellent connectivity to Noida, Greater Noida, and other major hubs. Spread across approximately 9.5 acres, the project offers modern living with quality construction, landscaped open spaces, and lifestyle amenities designed for families and investors.

Configuration & Size:

-

2 BHK Apartments – Approx. 730–1,172 sq.ft. (carpet area)

-

3 BHK Apartments – Approx. 996–1,400 sq.ft. (carpet area)

-

4 BHK Apartments – Approx. 1,426–1,547 sq.ft. (carpet area)

(Sizes are approximate and based on typical unit plans)

Price Range:

Approx. ₹1.60 Cr to ₹3.50+ Cr** (may vary depending on configuration and floor)

RERA Registration Number:

UPRERAPRJ110163/08/2025

Investment Potential:

Godrej Arden offers strong investment potential for 2026 due to several compelling reasons:

-

Strategic Location: Sector Sigma 3 is well connected to the Noida–Greater Noida Expressway and major road networks, enhancing convenience and future growth prospects.

-

Trusted Developer: Developed by Godrej Properties, a reputed and trusted brand in Indian real estate, the project benefits from quality construction, timely delivery, and strong resale demand.

-

Attractive Lifestyle: With well‑designed apartments and community amenities, Godrej Arden appeals to both families and professionals, which supports both rental demand and long‑term value appreciation.

-

Growth Drivers: Proximity to upcoming infrastructure upgrades and easy access to key employment and commercial hubs make this location a promising choice for real estate investors.

Overall, Godrej Arden stands out as a high‑potential investment choice in Greater Noida for those targeting capital appreciation and steady rental yield in 2026 and beyond. Read More…

8. AU Leisure Valley – Techzone IV, Greater Noida West

Project Overview:

AU Leisure Valley is a luxury residential project developed by AU Real Estate, located in Techzone IV, Greater Noida West (Noida Extension) — one of the fastest-growing residential hubs in Delhi NCR. Spread across approximately 24 acres, the project offers premium, spacious 3 BHK residences designed for comfort, modern living, and a community-oriented lifestyle. With thoughtfully planned layouts, abundant green spaces, and world-class amenities, this project appeals strongly to both homebuyers and investors seeking long-term value.

Configuration & Size:

-

3 BHK + Store – Approx. 2,176 sq.ft.

-

3 BHK – Approx. 2,188 sq.ft.

Price Range:

Approx. ₹1.73 Cr to ₹1.75 Cr** (may vary by unit & floor)

Investment Potential:

AU Leisure Valley offers strong investment potential for 2026 due to several key factors:

-

Prime Location: Situated in Techzone IV, the project benefits from excellent connectivity to Noida, Delhi, Ghaziabad, and major expressways, making it highly attractive for daily commuters and long-term residents.

-

Spacious Apartments: Large 2,100+ sq.ft. configurations are rare in Noida Extension, appealing to families and premium segment buyers, which supports resale demand and rental interest.

-

Infrastructure Growth: The area is witnessing continuous infrastructure development, including metro extensions, expressway improvements, and proximity to upcoming employment hubs, boosting property appreciation.

-

Lifestyle & Amenities: The project offers world-class amenities such as a resort-style clubhouse, fitness and wellness areas, landscaped gardens, and premium community spaces, enhancing quality of living and long-term rental demand.

With its strategic location, premium amenities, and spacious layouts, AU Leisure Valley is a promising investment opportunity in Greater Noida West for investors seeking capital appreciation and strong rental yields by 2026. Read More…

9. Birla Pravaah – Sector 71, Gurugram

Project Overview:

Birla Pravaah is a luxury residential project by Birla Estates located in Sector 71, Gurugram, one of the city’s fastest-growing residential corridors. Spread across approximately 5–5.5 acres, the project offers high-rise, elegantly designed apartments with modern construction standards, spacious layouts, and world-class amenities. Its strategic location near major expressways and business hubs makes it attractive for both homebuyers and investors.

Configuration & Size:

-

3 BHK Apartments – Approx. 1,900–2,000 sq.ft.

-

3.5 BHK Apartments – Approx. 2,400–2,450 sq.ft.

Price Range:

Approx. ₹3.26 Cr onwards* (may vary depending on unit size and floor)

RERA Registration Number:

RC/REP/HARERA/GGM/1006/738/2025

Investment Potential:

Birla Pravaah offers strong investment potential for 2026 due to several key factors:

-

Prime Gurgaon Location: Sector 71 is a high-demand residential and investment corridor, with excellent connectivity to NH‑48, Sohna Road, Golf Course Extension Road, and major commercial hubs, enhancing both livability and future price appreciation.

-

Spacious & Premium Apartments: Large 3–3.5 BHK units attract families and professionals, supporting both resale value and rental demand.

-

Trusted Developer: Birla Estates is a reputed real estate developer in India, known for quality construction and timely project delivery, which adds credibility and resale value.

-

Lifestyle & Amenities: The project features landscaped open spaces, clubhouse, fitness facilities, and recreational zones, ensuring a premium lifestyle and strong tenant interest.

Overall, Birla Pravaah is a high-potential investment project in Gurugram for investors looking for capital appreciation and stable rental returns by 2026. Read More…

10. Ivory County – Sector 115, Noida

Project Overview:

Ivory County is a premium residential project located in Sector 115, Noida, one of the most sought-after residential and investment locations in Delhi NCR. Developed with modern architecture and thoughtfully planned living spaces, Ivory County offers a mix of comfortable homes and lifestyle amenities. Its strategic location ensures seamless connectivity to major expressways, commercial zones, and social infrastructure, making it a strong choice for both homebuyers and real estate investors.

Configuration & Size:

-

3 BHK Apartments – Approx. 1,200–1,400 sq.ft.

-

4 BHK Apartments – Approx. 1,800–2,200 sq.ft.

(Sizes are indicative based on typical layouts and project offerings)

Price Range:

Approx. ₹1.60 Cr to ₹2.80 Cr** (may vary with configuration & floor)

RERA Registration Number:

UPRERAPRJ94720017054

Investment Potential:

Ivory County offers strong investment potential for 2026 due to the following reasons:

-

Prime Noida Location: Situated in Sector 115, this project benefits from excellent connectivity to the Noida-Greater Noida Expressway, Yamuna Expressway, and nearby metro stations, enhancing convenience and long-term demand.

-

Growing Residential Hub: Sector 115 is a well-developed and high-demand residential area with quality schools, hospitals, shopping centers, and daily conveniences that attract both families and professionals.

-

Balanced Product Mix: With 3 & 4 BHK configurations, Ivory County caters to both mid-segment buyers and premium families, improving liquidity and resale potential for investors.

-

Rental Demand: Due to its location and nearby employment hubs, the project is likely to attract quality tenants, offering healthy rental yields.

Overall, Ivory County stands out as a compelling investment option in Noida for real estate investors targeting capital appreciation and rental income by 2026 and beyond. Read More…

11. Max Estates 128 Noida – Sector 128, Noida

Project Overview:

Max Estates 128 Noida is an ultra-luxury residential project located in Sector 128, Noida, one of the most premium and low-density residential sectors along the Noida-Greater Noida Expressway. Developed by Max Estates, the project focuses on spacious living, high-quality construction, and a wellness-oriented lifestyle. With limited residences, abundant greenery, and proximity to major corporate hubs, this project is ideal for luxury homebuyers and long-term investors.

Configuration & Size:

-

4 BHK Luxury Apartments – Approx. 3,200–3,500 sq.ft.

-

5 BHK Ultra-Luxury Apartments – Approx. 4,500–4,800 sq.ft.

Price Range:

Approx. ₹7.50 Cr to ₹12 Cr** (price may vary based on size, floor & view)

RERA Registration Number:

UPRERAPRJ29880024356

Investment Potential:

Max Estates 128 Noida offers excellent investment potential for 2026 due to the following factors:

-

Prime Expressway Location: Sector 128 is among the most elite addresses in Noida, offering direct access to the Noida-Greater Noida Expressway and seamless connectivity to Delhi, South Noida, and major business districts.

-

Ultra-Luxury Segment: Limited inventory of 4 & 5 BHK homes ensures exclusivity, high demand, and better price appreciation in the luxury segment.

-

Trusted Developer: Max Estates is known for premium developments with a focus on sustainability, wellness, and long-term value creation, boosting investor confidence.

-

High Rental & Resale Demand: Due to proximity to IT parks, multinational offices, and premium social infrastructure, the project attracts senior professionals and corporate tenants, supporting strong rental yields.

Overall, Max Estates 128 Noida is a top-tier luxury investment opportunity in Delhi NCR for investors targeting capital appreciation, exclusivity, and stable long-term returns by 2026. Read More…

12. M3M Jacob & Co – Sector 97, Noida (Noida Expressway)

Project Overview:

M3M Jacob & Co is an ultra-luxury residential project by M3M India located in Sector 97 on the Noida Expressway, one of Delhi NCR’s premium real estate corridors. Spread across approximately 6 acres, the development features high-end residences with expansive floor plans, superior finishes, and world-class lifestyle amenities. Designed for affluent buyers and investors, the project combines international design sensibilities with contemporary living standards, making it a standout luxury option in Noida.

Configuration & Size:

-

3 BHK Apartments – Approx. 2,500 sq.ft.

-

4 BHK Apartments – Approx. 4,500 sq.ft.

-

5 BHK Apartments – Approx. 6,400 sq.ft.

(Sizes are approximate and indicative for typical unit types.)

Price Range:

Approx. ₹7.75 Cr onwards* (indicative starting price; may vary by configuration, size, and floor).

RERA Registration Number:

UPRERAPRJ690055/10/2025

Investment Potential:

M3M Jacob & Co offers strong investment potential for 2026 for the following reasons:

-

Ultra-Luxury Appeal: As one of the rare ultra-luxury branded residential projects in Noida, it attracts high-net-worth individuals seeking premium living standards and exclusivity, which supports stronger demand and appreciation.

-

Strategic Noida Expressway Location: Sector 97 benefits from excellent connectivity to the Noida Expressway, Delhi border, Greater Noida, business hubs, and social infrastructure, making it a highly desirable address.

-

Spacious Layouts: Exceptionally large apartment sizes — especially the 5 BHK units — cater to premium segment buyers and families looking for luxury homes, often translating into better resale value and long-term investment returns.

-

Lifestyle & Amenities: With high-end amenities, landscaped spaces, and superior community features, the project supports quality living and strong rental appeal, making it suitable for both end-users and investors.

Overall, M3M Jacob & Co is positioned as a top-tier luxury investment choice in Noida Expressway for 2026, offering both capital appreciation potential and differentiated premium asset value. Read More…

13. L&T Green Reserve – Sector 128, Noida (Noida Expressway)

Project Overview:

L&T Green Reserve is an ultra-luxury residential development by L&T Realty located in Sector 128, Noida, one of the most prestigious and sought-after addresses along the Noida Expressway in Delhi NCR. Spread over approximately 6 acres, the project offers premium apartments with expansive layouts, quality finishes, and a range of lifestyle amenities. Its strategic position close to major road networks, business hubs, and social infrastructure makes it appealing to both homebuyers and investors.

Configuration & Size:

-

3 BHK Apartments – Approx. 2,850–3,015 sq.ft.

-

4 BHK Apartments – Approx. 3,555 sq.ft.

-

5 BHK Apartments – Approx. 5,085–5,720 sq.ft.

(Sizes are indicative based on typical unit plans and premium layouts.)

Price Range:

Approx. ₹6.27 Cr to ₹8.25 Cr** (approximate range depending on configuration and floor level)

RERA Registration Number:

UPRERAPRJ459796/09/2025 & UPRERAPRJ794300/09/2025 (multiple towers registered under separate RERA IDs)

Investment Potential:

L&T Green Reserve offers excellent investment potential for 2026 due to several strong fundamentals:

-

Prime Expressway Location: Sector 128 is a highly desirable residential sector on the Noida Expressway with excellent connectivity to Delhi, Greater Noida, and major employment hubs — a key driver for both demand and price appreciation.

-

Ultra-Luxury Appeal: With spacious 3, 4, and 5 BHK apartments featuring expansive layouts and premium finishes, the project attracts affluent buyers and families, supporting strong resale value in the luxury segment.

-

Reputed Developer: L&T Realty, backed by the strong legacy of Larsen & Toubro, is known for quality construction, design excellence, and reliable execution — features that enhance investor confidence and asset stability.

-

Lifestyle & Amenities: The project includes high-end amenities such as a luxury clubhouse, swimming pools, landscaped gardens, fitness centers, sports facilities, and secured community spaces — enhancing everyday living and tenant appeal.

-

Future Growth Drivers: Proximity to upcoming infrastructure projects, quality educational institutions, hospitals, and retail hubs along the Noida Expressway corridor supports steady capital appreciation and strong rental demand over time.

Overall, L&T Green Reserve stands out as a premium investment opportunity in Noida for investors targeting capital appreciation, luxury lifestyle appeal, and strong long-term returns by 2026 and beyond. Read More…

14. Experion Elements – Sector 45, Noida

Project Overview:

Experion Elements is a premium residential project developed by Experion Developers and located in Sector 45, Noida — a well-connected and highly demanded residential micro-market in Delhi NCR. The project is designed to offer modern living spaces with contemporary architecture, smart layouts, and lifestyle amenities that cater to families and working professionals. With its strategic location, strong social infrastructure, and quality planning, Experion Elements attracts both homebuyers and real estate investors.

Configuration & Size:

-

3 BHK Apartments – Approx. 2975 sq.ft.

-

4 BHK Apartments – Approx. 3530 sq.ft.

(Sizes are indicative based on typical unit plans.)

Price Starting from :

Approx. ₹5.95 Cr* (may vary depending on unit size, floor & configuration)

RERA Registration Number:

UPRERAPRJ12220022142

Investment Potential:

Experion Elements offers good investment potential for 2026 due to the following reasons:

-

Strategic Location in Noida: Sector 45 is a prime residential sector with excellent connectivity to major expressways, metro stations, corporate hubs, schools, hospitals, and retail centers — all key drivers of long-term property demand.

-

Affordable Luxury Mix: With a balanced mix of 2 BHK and 3 BHK configurations, the project appeals to both first-time buyers and growing families, improving resale liquidity and demand.

-

Ready/Lifestyle Advantage: The project’s modern amenities and smartly planned homes enhance everyday living, making it attractive to both end-users looking to move in and investors seeking rental demand.

-

Resale & Rental Demand: Due to strong demand in Sector 45 from IT and corporate professionals, properties here often enjoy steady rental income potential and solid resale prospects.

Overall, Experion Elements is a worthwhile investment option in Noida for investors targeting capital appreciation and rental income by 2026 and beyond, especially in the mid-to-upper residential segment. Read More…

15. Sobha Aurum – Sector 36, Greater Noida

Project Overview:

Sobha Aurum is a premium residential project by Sobha Limited, strategically located in Sector 36, Greater Noida — a well-connected and fast-emerging residential and investment corridor in Delhi NCR. Designed with modern architecture, superior quality construction, and thoughtful planning, the project offers comfortable living spaces and lifestyle amenities tailored for families and investors. Its proximity to expressways, institutional hubs, and infrastructure growth makes it a compelling choice for both end-users and long-term investors.

Configuration & Size:

-

2 BHK Apartments – Approx. 875–980 sq.ft.

-

3 BHK Apartments – Approx. 1,250–1,350 sq.ft.

-

4 BHK Apartments – Approx. 1,750–1,900 sq.ft.

(Sizes are indicative based on typical unit plans and available configurations.)

Price Range:

Approx. ₹1.5 Cr** (price may vary depending on configuration, size, and floor)

RERA Registration Number:

UPRERAPRJ18600041952

Investment Potential:

Sobha Aurum offers promising investment potential for 2026 due to multiple key factors:

-

Strategic Greater Noida Location: Sector 36 is well connected to the Noida-Greater Noida Expressway, Delhi, and Ghaziabad, supporting strong residential demand and high interest from working professionals and families.

-

Reputed Developer: Sobha Limited is a well-established and trusted real estate developer known for premium quality construction, attention to detail, and timely delivery, which enhances resale value and investor confidence.

-

Diverse Configuration Mix: With 2, 3, and 4 BHK apartments, the project appeals to a broad audience — first-time buyers, families, and upgraders — improving absorption rates and liquidity.

-

Lifestyle Amenities: The project offers modern facilities such as landscaped gardens, clubhouse, fitness centers, children’s play areas, and recreational spaces that support quality living and attract quality tenants for rental income.

Overall, Sobha Aurum is a viable investment option in Greater Noida for investors seeking capital appreciation and rental yield by 2026 and beyond, especially in the mid-to-premium residential segment. Read More…

Best Real Estate Projects by Category

Choosing the right real estate project depends on your investment goal, budget, and risk appetite. Delhi NCR offers diverse options across luxury residences, affordable housing, plotted developments, and commercial projects. Below is a categorized guide to help investors make informed decisions.

Best Luxury Projects for High Appreciation

Luxury real estate projects in Delhi NCR are ideal for investors seeking. Premium lifestyle, strong brand value, and long-term capital appreciation. These projects are usually located in prime sectors with excellent connectivity, high-end amenities, and reputed developers.

Key benefits of luxury projects include:

-

Higher appreciation potential in prime locations

-

Strong resale demand

-

Premium rental income from corporate tenants and HNIs

-

Superior construction quality and lifestyle amenities

Luxury projects are best suited for high-budget investors and end-users looking for exclusivity and long-term value growth.

Best Affordable Projects for First-Time Investors

Affordable housing projects are perfect for first-time investors and end-users with limited budgets. These projects are usually located in emerging sectors with upcoming infrastructure and offer steady appreciation over time.

Why affordable projects are a smart choice:

-

Lower entry cost

-

High demand among end-users

-

Easier resale and rental opportunities

-

Suitable for long-term wealth creation

Affordable projects in NCR often deliver stable returns with lower risk, making them ideal for beginners in real estate investment.

Best Plotted Developments for Long-Term Returns

Plotted developments are among the most preferred investment options for long-term capital appreciation. With limited supply and increasing land value, plots provide higher growth potential compared to apartments.

Advantages of plotted developments:

-

No depreciation like built-up properties

-

Higher appreciation over time

-

Flexible construction options

-

Low maintenance cost

Plots near expressways, upcoming airports, and industrial corridors are especially attractive for investors planning long-term holding.

Best Commercial Projects for Rental Income

Commercial real estate projects are ideal for investors seeking regular rental income and higher yields. Offices, retail spaces, and mixed-use developments in high-footfall areas generate consistent cash flow.

Key reasons to invest in commercial projects:

-

Higher rental yield compared to residential

-

Long-term lease agreements

-

Demand from IT, retail, and corporate sectors

-

Inflation-hedged income

Commercial properties are best suited for investors focused on passive income and portfolio diversification.

FAQs – Top Real Estate Investment Questions in Delhi NCR

Q1. Which is the best location to invest in real estate in Delhi NCR in 2026?

In 2026, Noida, Noida Extension, Yamuna Expressway, Dwarka Expressway (Gurgaon), and NH-24 Ghaziabad. Are considered some of the best locations for real estate investment in Delhi NCR. These areas offer strong infrastructure development, better connectivity, and high potential for capital appreciation.

Q2. Is 2026 a good time to invest in Delhi NCR real estate?

Yes, 2026 is expected to be a favorable year for real estate investment in Delhi NCR. Due to ongoing infrastructure projects, increasing housing demand, stable property prices, and improved transparency under RERA regulations.

Q3. Which type of property gives the highest ROI in Delhi NCR?

Properties located near expressways, metro corridors, and upcoming infrastructure projects generally deliver higher ROI. Premium residential projects by reputed builders and plotted developments in emerging locations often show strong long-term appreciation.

Q4. What is the expected rental yield in Delhi NCR?

Rental yield in Delhi NCR typically ranges between 3% to 4.5%, depending on location, property type, and demand. Areas close to business hubs, IT parks, and metro stations usually offer better rental income.

Q5. Is it safe to invest in under-construction projects in Delhi NCR?

Yes, investing in under-construction projects can be safe. If the project is RERA-registered, developed by a reputed builder, and has a good track record of timely delivery. Such projects also offer better price appreciation compared to ready properties.

Q6. Should I choose luxury apartments or affordable housing for investment?

Affordable and mid-segment housing offers higher rental demand and liquidity, while luxury apartments provide better long-term appreciation and premium tenants. The right choice depends on your budget, investment horizon, and income expectations.

Q7. What budget is ideal for real estate investment in Delhi NCR?

An investment budget starting from ₹50–70 lakhs can secure good residential options in emerging areas. While ₹1.5 crore and above is suitable for premium and luxury projects in prime locations.

Q8. Are RERA-approved projects mandatory for investment?

Yes, investing in RERA-approved projects is highly recommended. As it ensures legal compliance, project transparency, buyer protection, and accountability from the developer.

Q9. Which Delhi NCR micro-markets will grow fastest by 2030?

Micro-markets such as Yamuna Expressway, Noida Extension, Dwarka Expressway. And select sectors of Greater Noida and Ghaziabad expected to witness rapid growth. Due to infrastructure expansion and increasing residential demand.

Q10. How long should I hold a property for maximum returns in Delhi NCR?

A holding period of 5–8 years is ideal to maximize capital appreciation and rental returns. Especially in emerging locations with ongoing infrastructure development.

Final Thoughts

Investing in real estate in Delhi NCR in 2026 presents a strong opportunity for both end-users and long-term investors. With rapid infrastructure development, expanding expressway networks, metro connectivity. And growing employment hubs, the region continues to offer a balanced mix of capital appreciation, rental income, and lifestyle upgrades.

Locations such as Noida, Greater Noida, Yamuna Expressway, Gurugram, and Ghaziabad. Are emerging as high-growth micro-markets, driven by improved connectivity and planned urban development. Projects by reputed developers, especially those that RERA-approved, provide greater transparency, safety, and long-term value.

Moreover, you are looking for luxury homes, affordable apartments, plotted developments, or rental-income properties. Delhi NCR has options to suit every investment goal. The key is to choose the right location, trusted builder, and a long-term investment horizon.

Also, If you planning to invest in Delhi NCR real estate in 2026, now the right time to act. Early investments in growing corridors can deliver higher returns and steady rental demand in the coming years.

Leave a Reply